Tax calculator 401k to roth ira

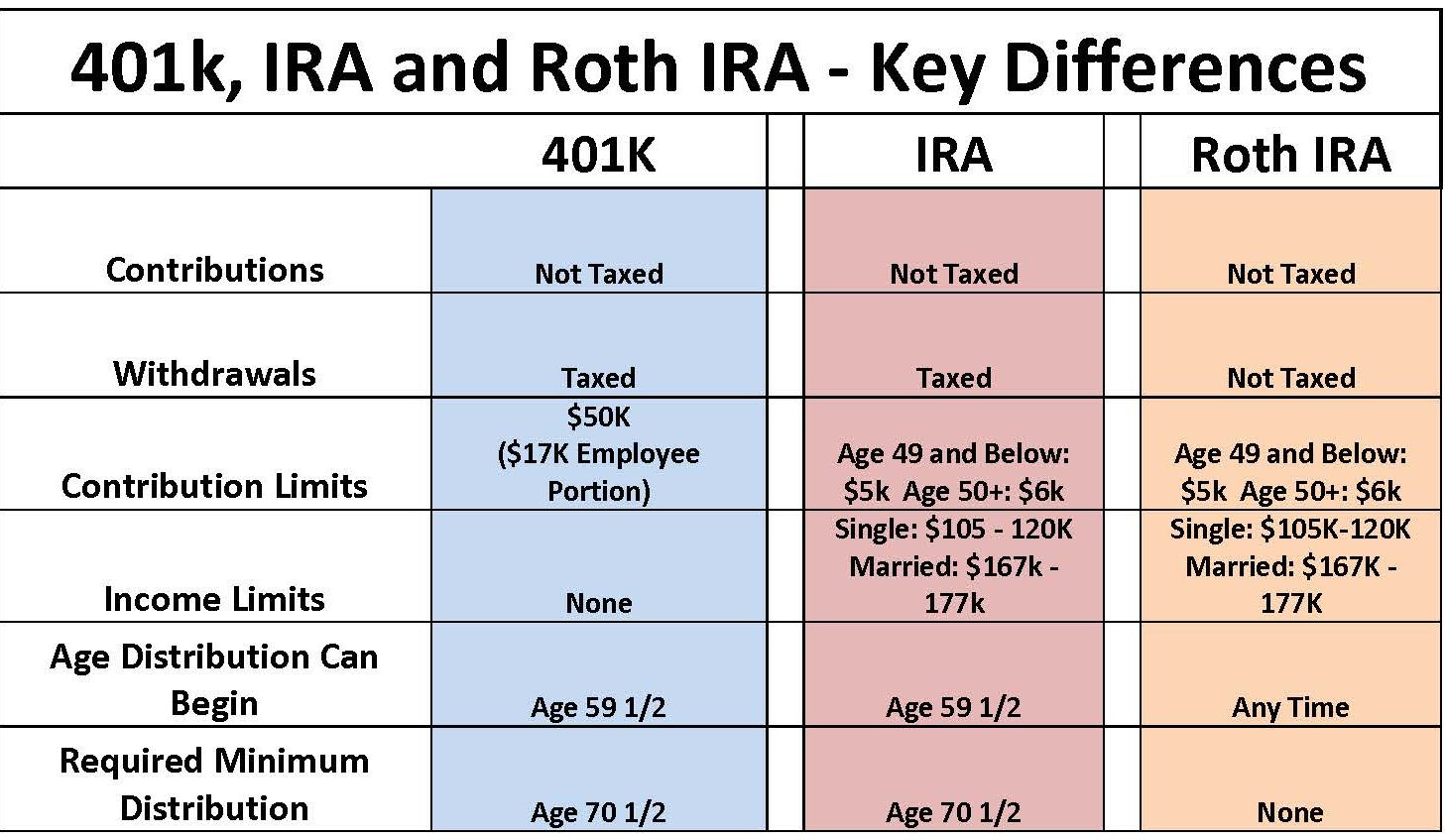

When planning for retirement there are a number of key decisions to make. Since Roth IRA withdrawals in retirement are tax-free it would be worth more in retirement than 1000 in your taxable 401k account.

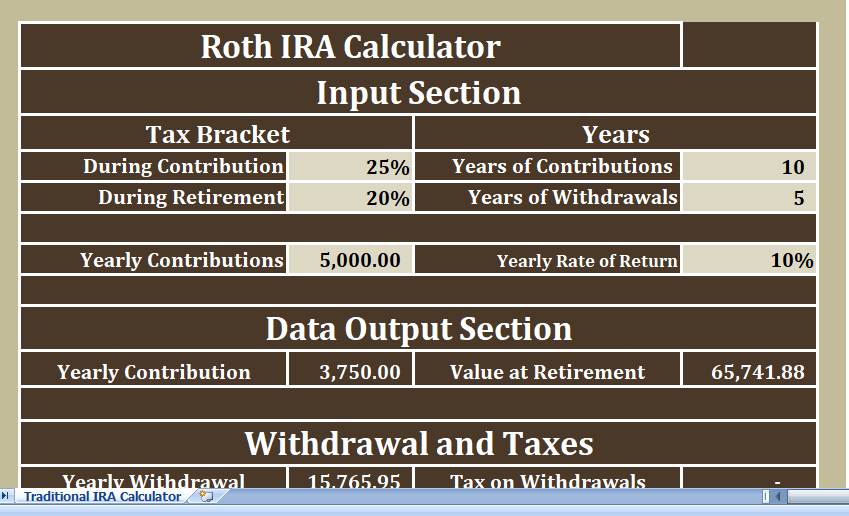

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Federal income tax must be paid on the interest or earnings from a non-qualified.

. Ideally you should be getting the most out of your 401k and Roth IRA. Because a standard 401k is funded with before-tax dollars you will need to pay taxes on those funds in order to move that money into an after-tax funded Roth IRA account. The calculator will estimate the value of the Roth IRAs tax-free investment growth by comparing your projected Roth IRA account balance at retirement with the balance you would have if you.

Additional Roth IRA Calculators. Ad Explore Your Choices For Your IRA. It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. So lets say youre able to set aside 5000 a year across all three accounts.

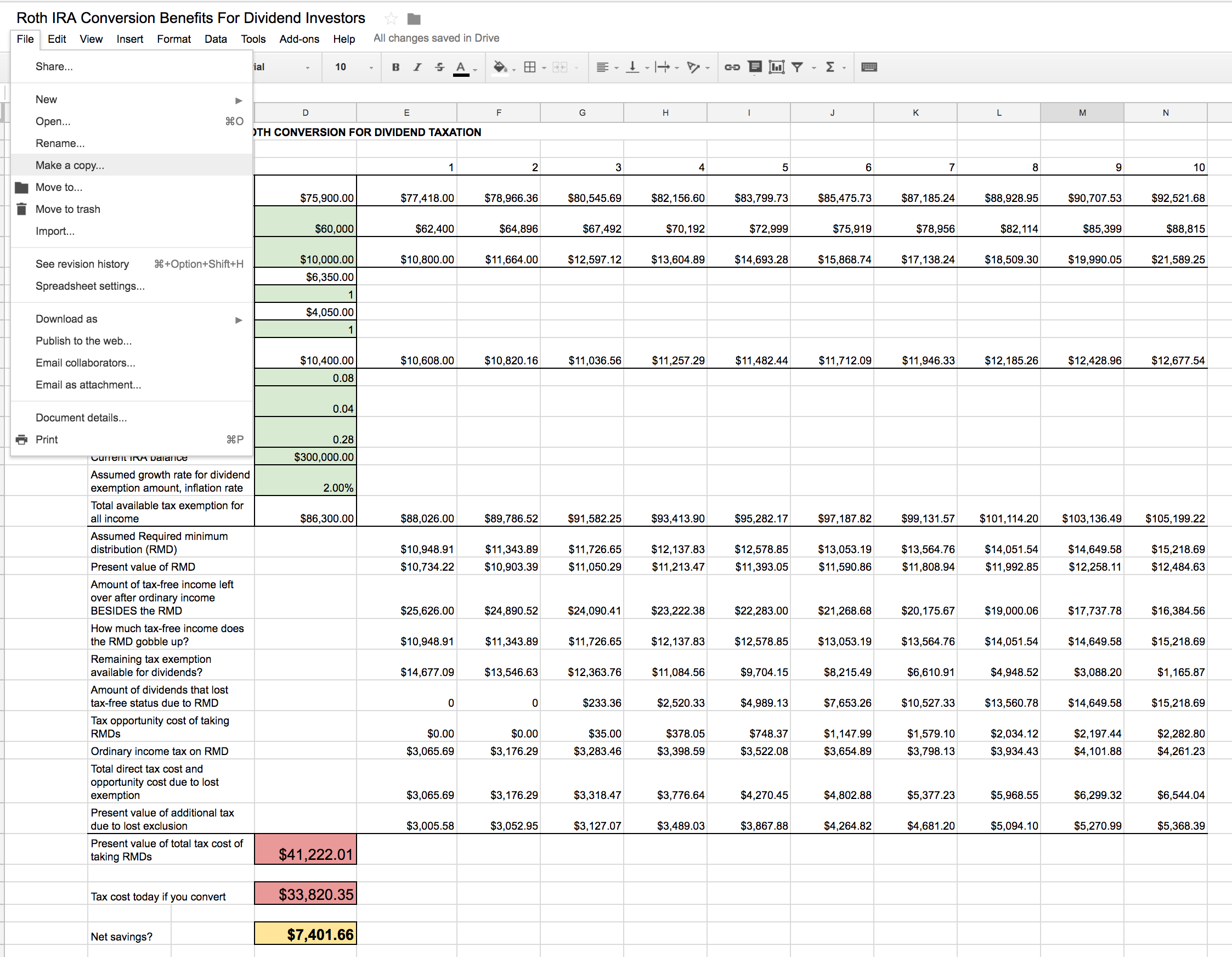

This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA. The information in this tool includes education to help you determine if converting your. For some investors this could prove.

Do Your Investments Align with Your Goals. Both are tax-advantaged retirement accounts but there are differences between the two. Find a Dedicated Financial Advisor Now.

Get Up To 600 When Funding A New IRA. Roth Conversion Calculator Methodology General Context. The Roth 401 k allows you to contribute to your 401 k account on an after.

The calculator will estimate the monthly payout from your Roth IRA in retirement. So when you roll over a traditional 401 k to a Roth IRA youll owe income taxes on that money in the year when you make the switch. Ad Learn More About Our Roth Traditional IRA Accounts Well Help You Roll Over Your 401K.

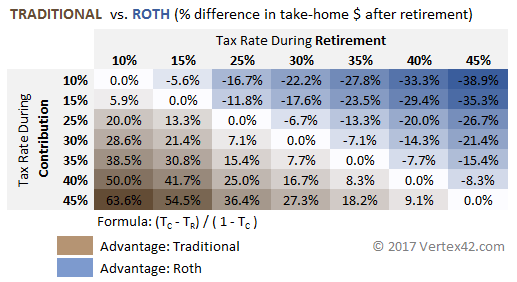

Converting to a Roth IRA may ultimately help you save money on income taxes. Explore Choices For Your IRA Now. This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401.

Traditional or Rollover Your 401k Today. Discover Fidelitys Range of IRA Investment Options Exceptional Service. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

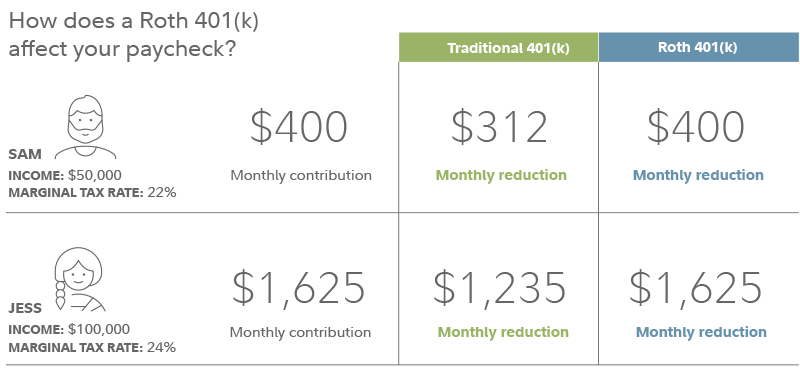

Otherwise you would do so and you. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay.

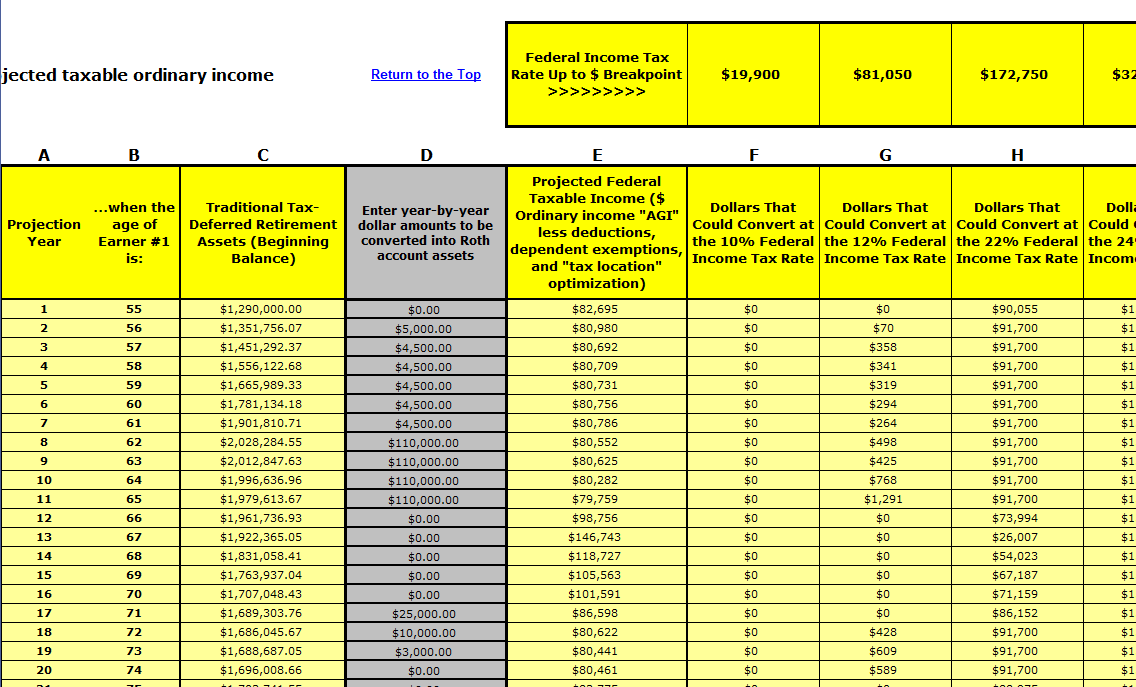

Reviews Trusted by Over 45000000. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. For instance if you expect your income level to be lower in a particular year but increase again in later years.

Compare 2022s Best Gold IRAs from Top Providers. A Roth IRA is entirely useless if you dont spend the money in your Roth IRA. This calculator compares two alternatives with equal out.

The major difference between Roth IRAs and traditional IRAs is. There are many factors to consider including the amount to convert current tax rate and your age. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

This is best understood using an example. The total amount transferred will be. They can be purchased in any Roth retirement account like a IRA IRA or a Roth 401k.

Ad Explore Your Choices For Your IRA. Explore Choices For Your IRA Now. Ad Open an IRA Explore Roth vs.

Get Up To 600 When Funding A New IRA. When you convert from a traditional IRA to a Roth IRA the amount that you convert is added to your gross income for that tax year. Get Up To 600 When Funding A New IRA.

Roth Conversion Calculator Methodology General Context. It increases your income and you pay your. Once You Retire You Wont Pay Taxes When You Withdraw Your Money.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Get Up To 600 When Funding A New IRA. Traditional vs Roth Calculator.

If your employer will match 401 k contributions in full up to 3000 then your best bet is to put. Assume your 401 k account is 100000 consisting of 60000 six-tenths of pre-tax dollars and 40000 four-tenths of after-tax dollars. Your IRA could decrease 2138 with a Roth.

Make a Thoughtful Decision For Your Retirement. Below the number one area for financial education Im going to go over 3 of the most effective Roth IRA. This calculator will show the advantage.

A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

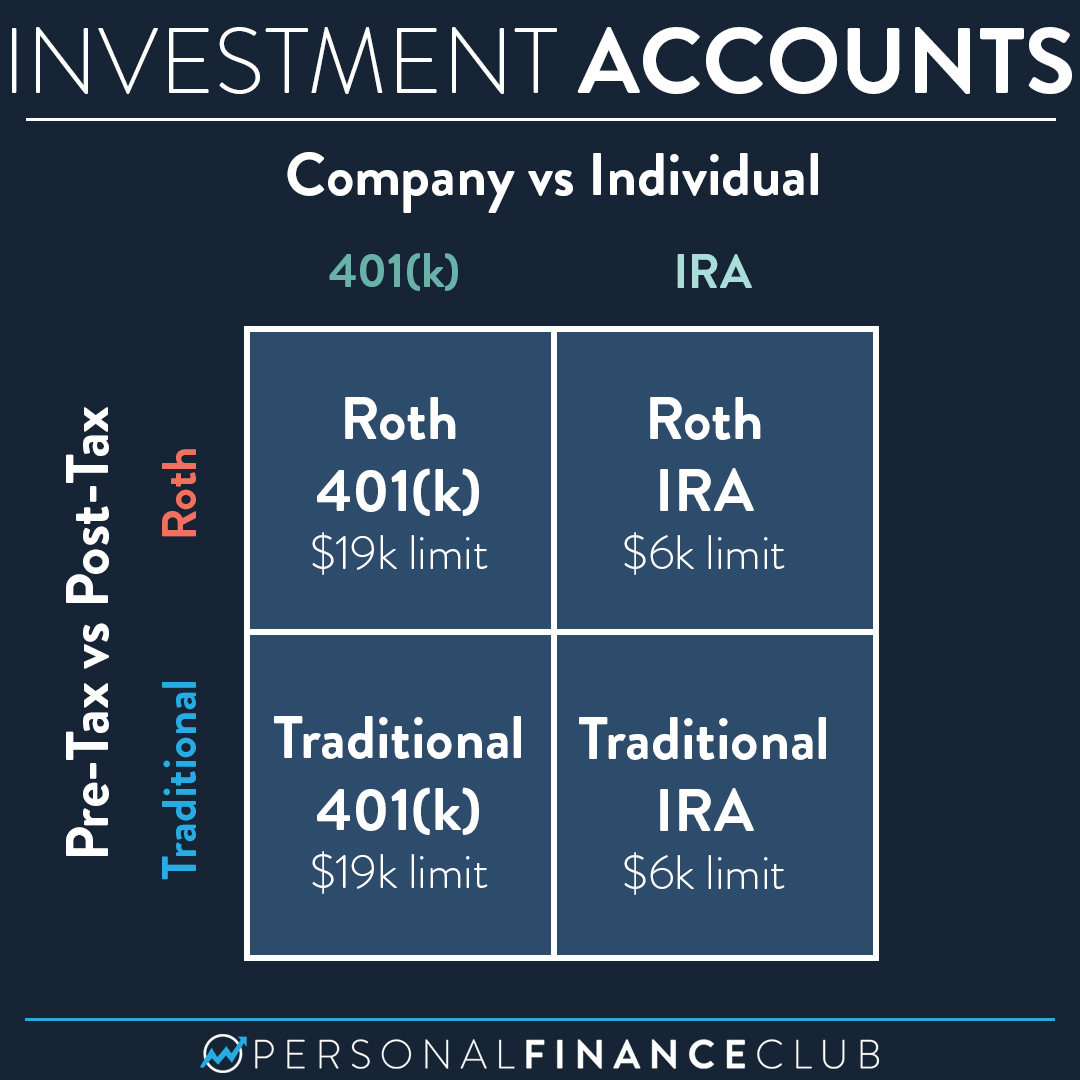

Ira Vs 401 K And Roth Vs Traditional Personal Finance Club

What Is The Best Roth Ira Calculator District Capital Management

Roth 401k Roth Vs Traditional 401k Fidelity

Traditional Vs Roth Ira Calculator

Roth Ira Conversion Spreadsheet Seeking Alpha

Roth Ira Conversion Calculator Excel

Retirement Accounts And Tax Benefits Cpa Near Me Tax Acct 602 274 7770

Roth Ira Calculator Excel Template For Free

The Tax Trick That Could Get An Extra 56 000 Into Your Roth Ira Every Year

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Traditional Vs Roth Ira Calculator

The Ultimate Roth 401 K Guide District Capital Management

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal